When are the Eurozone Preliminary CPIs and how could they affect EUR/USD?

Eurozone Preliminary CPIs overview

Eurostat will publish the first estimate of Eurozone inflation figures for February at 1000 GMT this Tuesday.

The headline CPI is anticipated to come in slightly softer at 1.2% YoY while the core inflation is seen up at 1.2% YoY during the reported month.

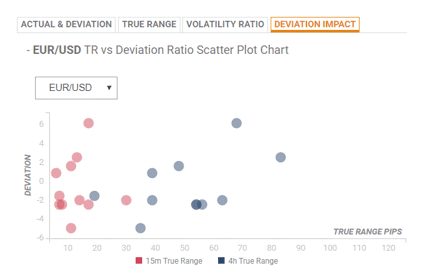

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 30 pips in deviations up to 1.5 to -2, although in some cases, if notable enough, a deviation can fuel movements of up to 45-50 pips.

How could affect EUR/USD?

Yohay Elam, FXStreet's own Senior Analyst, offers important technical levels ahead of the key release: “The Technical Confluences Indicator is showing that initial weak resistance awaits at 1.1162, which is the confluence of the Bollinger Band 15min-Upper and the Pivot Point one-month Resistance 1. The most significant cap is only at 1.1284, which is a cluster including the PP one-month Resistance 2, the Fibonacci 161.8% one-month, and the PP one-day R2.”

“Support awaits at 1.1093, which is the confluence of the 200-day Simple Moving Average, the Fibonacci 61.8% one-day, and the previous monthly high. Further down, additional noteworthy support is at 1.1035, which is where the BB 4h-Middle and the 50-day SMA converge,” Yohay adds.

Key notes

Eurozone: Flash core CPI to pick up slightly in February - TDS

EUR Futures: Extra gains on the cards

French FinMin Le Maire: Had a 'very positive' call on coronavirus with ECB President Lagarde

About Eurozone Preliminary CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).